Inflation

Positively, inflation remained on a downward trajectory in 2023 and in the first months of 2024. According to data from the Office for National Statistics (ONS), the year on year (y/y) increase of the consumer price index came in at 3.0% in April 2024, down from the 41-year high of close to 10% in late 2022 .

Meanwhile, the UK construction sector has seen above-average price increases in 2021-22, followed by a stronger correction from early 2023 onwards. Between June 2021 and February 2023, construction material prices increased by double digits in y/y terms, averaging a very high 23% in the twelve months to July 2022.

Positively, after having peaked at 26.8% in June 2022, construction materials price inflation has moderated substantially, falling into deflation territory in mid-2023. Latest available data for April 2024 shows another 3.1% y/y drop. While not all of this is welcome news (the sectoral slowdown has also driven prices lower), it helps construction sector companies to reduce their cost base and thereby increases affordability. Problematically, there are a few outliers to this positive trend: several product groups still recorded double digit price increases in the twelve months to April. Worst performers were pipes and fittings (up by 19.3% y/y), followed by metal doors and windows (+17.7%) and gravel, sand and clays (+11.3%).

Output

Latest data releases from the ONS indicate that construction had a bad start into 2024. Sectoral output has fallen by 2.2% in the three months to April, compared with the November 2023 to January 2024 period. This is the sixth consecutive drop in the three-monthly series. Out of the nine building sub-sectors covered by the ONS, seven reported an output drop in April with private housing new work (minus 4.4%) and private housing repair and maintenance (-2.5%) being the worst performers. The unusually wet spring also contributed to the sector’s disappointing performance but most of it is due to the lacklustre macroeconomic backdrop, high interest rates and difficult access to finance (which are all weighing on building activity).

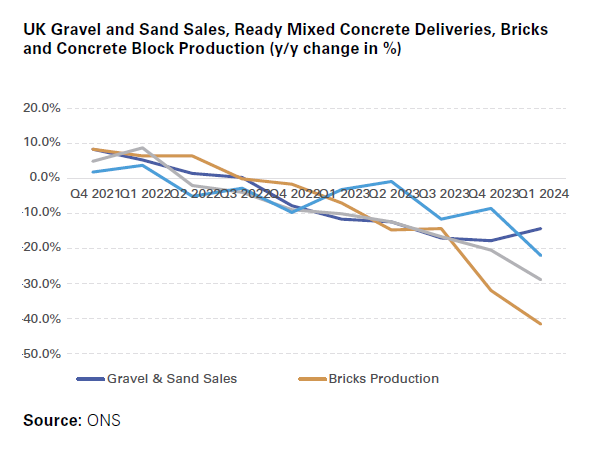

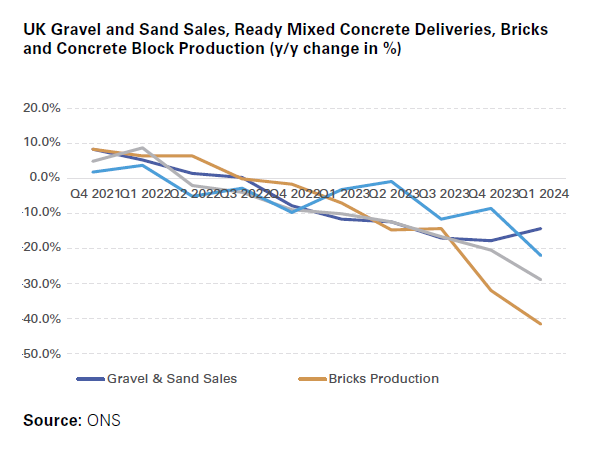

Other indicators mirror the underwhelming output figures in the British construction sector. Sand and gravel sales have fallen for six consecutive quarters now; latest figures show a 17.8% y/y drop in Q4 2023 and an additional 14.4% y/y fall in Q1 2024. Bricks production in the UK has also been on a downward trend for quite some time. Having contracted for seven quarters in a row, Q4 2023 saw a 32.1% y/y fall, followed by an even bigger drop in January-March 2024 when output shrank by 41.6%, the sharpest contraction since Q2 2020 (when the first Covid lockdown caused severe disruptions).

Simultaneously, concrete blocks production is also on a downward trend: having fallen for two years in a row now, January-March 2024 saw a steep 29.3% y/y drop, the worst performance since Q2 2020. Lastly, ready mixed concrete sales have also contracted (in y/y terms) for the past two years. Latest figures show a 8.8% fall in October-December 2023, followed by a 22.1% drop in the first quarter of 2024.

Labour Market (Vacancies, Wages)

Construction remains an important sector of the British economy. According to the ONS, the industry employed 6.0% of the UK workforce in March 2024 and generated 6.1% of total gross value added in the country in Q1 2024 . Generally, labour market conditions in the UK have deteriorated slightly over the past quarters: unemployment increased, nominal wage growth slowed down and the number of job vacancies dropped as the country fell into recession in Q4 2023.

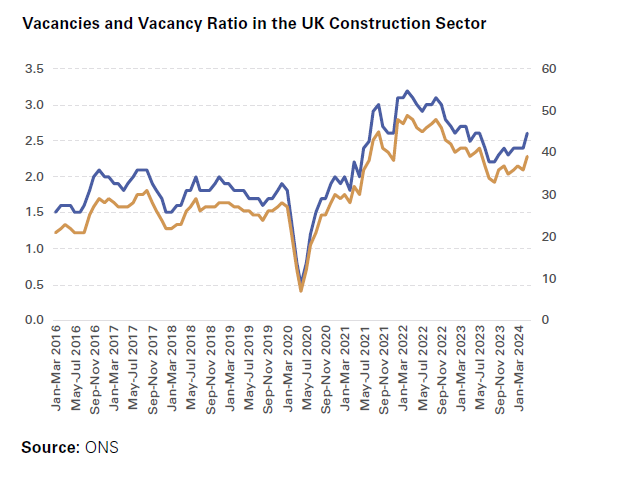

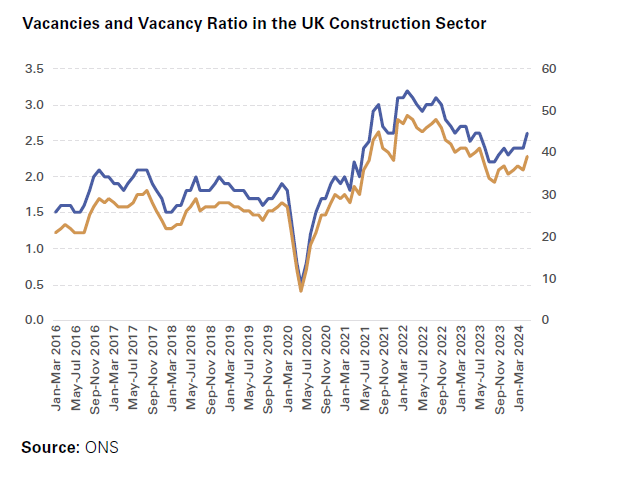

The construction sector was not immune to this downturn. The number of jobs in the industry has remained roughly stable over the past year but is down from 2.32m before the pandemic to 2.22m in January-March 2024. Meanwhile, the number of vacant positions in the sector has dropped from an all time high of 49,000 in January-March 2022 to 39,000 in March-May 2024. Simultaneously, the vacancy rate (measuring the amount of vacant positions per 100 employee jobs) has moved lower in the above-mentioned period: from 3.1 to 2.6, which is roughly in line with the national average of 2.8. Nonetheless, compared with Q4 2019, the last reading before the outbreak of the Covid pandemic, the labour market remains tight. Back then, there were only 26,000 vacant positions in the UK construction sector, equivalent to a vacancy ratio of 1.7.

Furthermore, wages in the sector are still rising, albeit by a much smaller pace than a year ago and also below the national average. For the country as a whole, nominal weekly earnings growth in January-April 2024 averaged 5.7% y/y while in the construction sector, the corresponding reading stood at 2.5% only. As inflation came in above this reading (moderating to still 3.0% in April), real wages in the sector continue to fall. The January-April 2024 earnings growth rate is down from 4.7% a year earlier (which, back then, also undershot inflation).

Outlook

While sectoral performance in 2023 and 2024 year to date has been lacklustre, the outlook is somewhat brighter, caused by a mix of higher macroeconomic growth, lower interest rates and improved confidence. That said, the general election in July is causing additional uncertainty for the wider economy.

Macroeconomics

Positively, the British economy has pulled out of recession in Q1 2024 when real GDP expanded by a surprisingly strong 0.6% quarter on quarter (q/q) or by 0.2% y/y. Admittedly (and as mentioned above), construction has not seen any improvement yet and output fell by 0.9% q/q and 0.7% y/y.

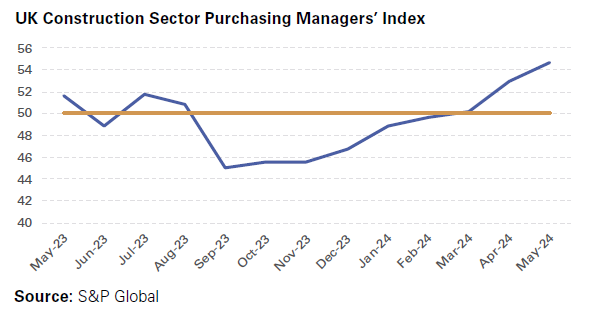

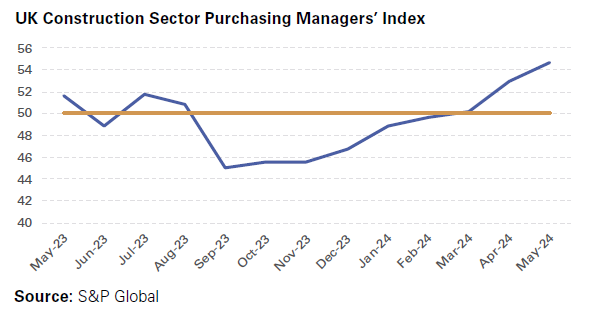

Encouragingly, the IMF has recently upgraded its 2024 UK real GDP growth forecast (from 0.5% to now 0.7%) and forward-looking indicators point towards a brighter second half of the year. Purchasing Managers’ Indices (PMI) in the British service and the manufacturing sectors have improved in recent months and the corresponding reading in the construction sector has also been on a generally upward trend since last autumn. In May 2024, the construction sector PMI (compiled by S&P Global) came in at 54.7 points, above the neutral 50-points line that divides sectoral expansion from contraction for the third straight month and the best reading in two years.

For the first time since May 2022, all three monitored sub-groups (residential building, commercial building, civil engineering) were in growth territory. Positively for the outlook for the second half of the year and early 2025, new order inflow remained in growth territory for the fourth month in a row, indicating a more solid pipeline for construction companies. The purchasing activity and employment sub-indices also improved in May. Although PMI survey respondents reported improving supply chain conditions, anecdotal evidence paints a slightly more negative picture. A number of contractor-failures in recent months has lead to delays on contracts, sending some projects back to the drawing board.

Anticipated interest rate developments will probably also support sectoral performance going into next year. In its latest assessment, the IMF has suggested that the UK key policy rate should drop from the current level of 5.25% to 3.50% by the end of 2025 . Markets expect two interest rate cuts by the Bank of England before the end of 2024, thereby reducing companies’ refinancing costs as well as mortgage rates somewhat.

Despite the much-awaited interest rate cuts and the broader economy set to switch into a higher gear, trade bodies in the construction sector are rather cautious about the remainder of 2024. For the year as a whole, the Construction Products Association (CPA) expects UK construction sector output to drop by 2.2%. As the number of houses built has dropped by 20% y/y in Q1 2024, according to the National House Building Council , housing delivery in England is on track to fall to the lowest level in a decade, according to estate agent Savills . Scaled back land buying has also had a negative effect on building activity. While increasing building starts will be a priority for the incoming government, it remains unclear how this goal can be achieved. Positively, the CPA is more upbeat about 2025-26: according to their latest forecasts, construction sector output will grow by 2.1% next year, followed by an even higher 3.6% in 2026.

Politics and Regulatory Environment

The incumbent government’s decision to hold a snap election on 4 July is complicating the outlook for the construction sector somewhat. All polls indicate a victory of the Labour Party, bringing an end to 14 years of increasingly erratic Conservative-led rule. The ramifications of such a change in government are impossible to quantify at the moment and things will become clearer once a new administration has taken office. In its election manifesto, Labour foresees significant investment in green energy and technologies, promises to build 1.5m homes over the next five years and announces the introduction of a Warm Homes Plan (which will increase demand for insulation) as well as a mortgage guarantee scheme which is aimed at supporting first time buyers.

The Labour Party also intends to create a new body, the National Infrastructure and Service Transformation Authority which will oversee a ten-year infrastructure investment strategy. Improving rail connectivity in the north of England, fixing potholes quicker and better preparing for natural disasters are measures that could all lead to higher public infrastructure investment (more hospitals and schools also feature on the list). While the response from trade bodies was largely positive, the Royal Institution of Chartered Surveyors again highlighted the need for planning reform and speeding up decision making. In addition, it remains unclear how large parts of Labour’s campaign promises will be financed as the underlying assumptions (such as revenue generation stemming from cracking down on tax evasion) look overly optimistic.

Regardless of the outcome of the election, ESG topics will continue to feature heavily in the sector’s in-tray. Net zero requirements are unclear (Labour has abandoned previous targets in early 2024) but it is evident that UK construction will need to invest heavily and reduce its carbon footprint over the next decade. With banks increasingly attaching environmental conditions to their loans, this is adding another layer of complexity and paperwork, especially for SMEs. That said, those companies adapting to the changing operating conditions can access new markets, experience higher demand for green services and products and can also (hopefully) rely on government funding to finance required investment.

Credit Risk

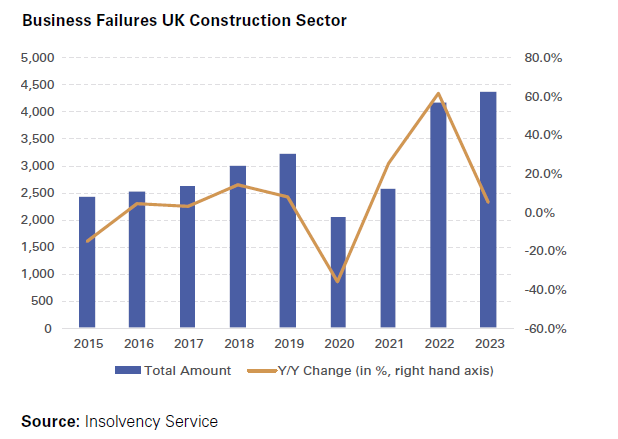

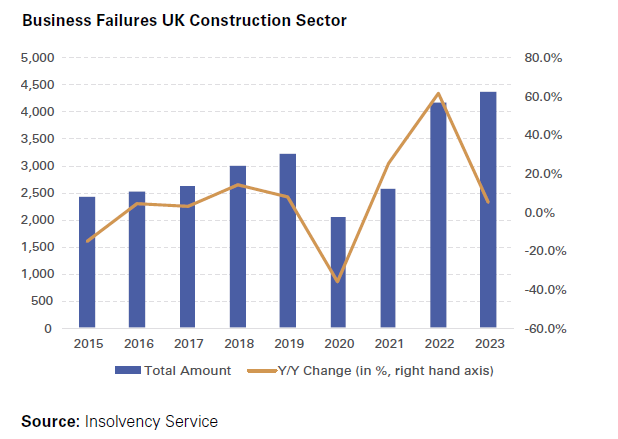

Historically, business failure risk in the sector has been high, due to a combination of small profit margins and fixed price contracts which left construction companies unable to pass on unexpected input price increases to customers. As a result, the sector is overrepresented in UK insolvency figures: although construction companies only accounted for 13.8% of all registered companies in the UK, they are responsible for 17.4% of all insolvencies in the country . Unfortunately, sectoral insolvency figures have been rising for three years in a row now (+5.2% in 2023) and they are more than a third above the 2019 reading, the last annual data point before the outbreak of the pandemic. Worryingly, the number of sectoral failures is now on the highest reading since the global financial crisis in 2009 .

Within the construction sector, electrical, plumbing and other construction installation activities recorded the most insolvencies (23% of all construction sector failures), followed by construction of residential and non-residential buildings (20%) and building completion and finishing (also 20%). Also problematically, several larger construction companies had filled for insolvency 12-18 months ago; the ripple down effect is now fully felt at the bottom of the industry value chain. Meanwhile, the collapse of smaller companies does not only create a financial damage at their suppliers, it potentially also creates long delays in completing projects. As a consequence, extension of time is already becoming an increasing problem in the sector.

Looking ahead, insolvency risk in the sector is likely to fall in the next quarters, albeit by a sluggish pace. Confidence indicators are improving and the economy will switch into a higher gear, thereby also supporting the sector. Interest rates should come down, thereby helping to increase investment in residential and non-residential building while a new, Labour-led government might increase public spending.

That said, improvements are unlikely to be sizable. Interest rate cuts will be small and the transmission process is slow. Many companies that have to roll over medium- or long-term debt will still face higher refinancing cost as even after the anticipated rate cuts in 2024-25, interest rate levels will be much higher than in the 2008-2022 period. At the same time, banks have tightened lending conditions over the past two years, complicating access to finance. On the fiscal policy front, room to manoeuvre is limited as government debt levels are high (standing at above 100% of GDP in late 2023) and yields have risen as well . It is unlikely that public infrastructure investment will pick up significantly, regardless of who is winning the July-election.

Furthermore, construction companies’ balance sheets haves taken a hit over the past two years, leaving a sizable share of the sector highly leveraged and unprotected against the higher interest rate environment (compared with pre-2023 levels). Revenue growth has often been driven by inflation, rather than organic growth, leaving some companies undercapitalised for the size of projects undertaken. In addition, large provisions for fire safety remediation work (a consequence of the Grenfell Tower fire in 2017) have also had an adverse impact on the financial health of once profitable companies. While things have started to improve over the past months and quarters, it will take some time until the damages caused by the high-inflation environment and the recession will disappear completely.

Lastly, poorer payments performance in the sector is also causing problems again. According to a 2023-study, large construction companies in the UK pay around 20% of their invoices late . This is especially worrisome for smaller companies towards the bottom of the supply chain as they tend to have smaller capital buffers and rely on prompt payments. Although the recent deterioration in B2B payments performance is only a normalisation towards pre-Covid levels (the sector always had a poor payments performance, compared with most other parts of the British economy), working capital cycles often have not adapted to the changing pattern yet. This is adding to the elevated credit risk levels for the foreseeable future.